The Philippines is undeniably one of the more interesting countries in Asia. With over a 100 million souls and a rapidly developing economy, there is a constant demand for pig meat and pork. What are the opportunities for the Philippines?

The swine industry of the Philippines is one where jobs and economic opportunity seem guaranteed for the next decade for those who want to commit to a career or investment in modern pig production and processing. Demand is growing, in line with population and income (and tourism), and meat consumption is expected to grow in parallel. And, on the supply side, there is a deficit in pork and pig meat for the processing industry at the moment. The industry is a ‘hot zone’ for an expanding and growing supply chain from farm to fork (genetics, AI, feed, animal health, and equipment) and for foreign suppliers and importers/processors of pork.

A farm in Luzon’s General Trias province, showing many modern, tunnel-ventilated pig buildings. Photo: Vincent ter Beek

Second largest economic activity

The swine sector is the second largest economic activity in the Philippines’ agricultural sector. Domestic pig production has been rising in both backyard and modern commercial farms. In 2016 (July 1), the total hog inventory in the Philippines was reported to be almost 12.5 million head – an increase of 1.4% compared with 2015.

Backyard farms accounted for 64% of these animals and commercial farms made up 36% of the total hog population. Approximately 35% of the total breeding herd (1.68 million sows or 560,000 head) were on commercial farms (July 1 census 2016).

The total breeding herd increased by 2.6% in 2016 and by 5.3% in 2015. The key regions for pig production are Central Luzon and Calabarzon which, together, account for almost two thirds of all commercial pig production. This proportion falls to around 30% of all pigs when backyard pig production is considered since these smaller units are spread more evenly around the Philippines. Although a lot of domestic pig meat is sold through wet markets there is a growing and vibrant meat processing sector which serves foodservice, retail and export customers. The Philippines’ Association of Meat Processors (Pampi) has around 50 company-members and claims that they account for more than P300 billion in revenues (US$ 6 billion) and provide jobs to more than 300,000 Filipinos.

Investments are evident

Investment in new production and processing capacity is evident. A recent example of this is the announcements by PIC of a new sire and dam line nucleus facility on the main island of Luzon, Hormel/San Miguel’s US$ 1.2 billion investment in doubling its meat processing capacity (to 120,000 tonnes) at General Trias, Cavite and the Charoen Pokphand Group’s (CP Group) plan to invest around US$ 2 billion on swine and poultry production in the Philippines in the next 5 years.

However, it’s not all plain sailing since the domestic swine industry has a record of low productivity and has only recently begun expanding albeit the majority of local producers (mainly backyard and small farmers) are unlikely to be part of ‘commercialisation’. A particular challenge for the Philippines is the high feed and energy prices that are prevalent: these affect all producers and contribute to a relatively high cost of production for the domestic industry (estimated at US$ 1.80 per kg).

San Miguel is one of the country’s largest conglomerates and meatpackers. The company aims to double its processing capacity in General Trias province. Photo: Vincent ter Beek

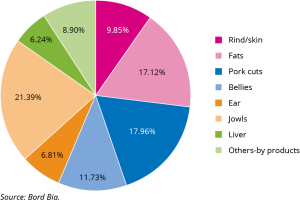

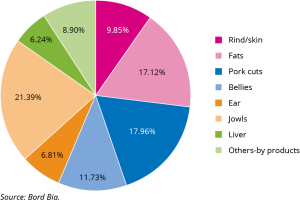

Although the Philippines has some significant export markets (mainly Middle East) pig meat imports have grown to meet these export customers’ needs (up by circa 12% from the EU in 2016) and this may put some parts of the local supply chain under significant cost pressure in the future. The meat processing sector complains that locally produced raw pig meat does not meet its quality or presentation requirements and those imports of suitable pig meat are the only way that it can satisfy its export and domestic customers and this may be the main reason why new investments in integrated production and processing capacity are being seen (Figure 1).

Reports of corruption and irregularities in customs processing are not uncommon as are complaints about unwieldy and bureaucratic SPS procedures and this may also be encouraging domestic investment. Lastly, the ever present threat of typhoons can seriously disrupt local production and this aspect of the weather’s behaviour affects decisions on location for new capacity.

Figure 1 – Breakdown of pig meat imports into the Philippines, 2015.

Hog Industry Roadmap

Under the auspices of the Bureau of Animal Industry (BAI) the swine industry’s supply chain has signed up to a ‘Hog Industry Roadmap’ which describes the major challenges facing the domestic industry and the way to meet them over the next decade.

This 26 page ‘action plan’ is most interesting and has been put together after consultations with commercial businesses and, if carried through, signals significant changes for local producers, their supply chain, and the value chain for pig meat in the Philippines. This plan envisages a growth of per capita consumption of pork in the Philippines from 14.9 kg/capita in 2015 to 16.4 kg/capita in 2017. This is relatively modest but still implies a growth of +30% in the domestic herd. The technical KPIs for production are also targets for improvement in the roadmap.

The number of pigs sold/sow/year is required to increase from 18.8 in 2015 to 30 in 2027, and the FCR needs to shrink from 3.7 to 2.27 in the next decade. A final, ambitious, target worth mentioning is to get carcass meat production per sow per year up from 1.7578 tonnes to 3.5445 tonnes in ten years. That’s an improvement of just over 100%. It’s easy to see why these target figures imply that the Philippines is a ‘hot zone’ for investments in modern pig production.

The Philippines at a glance

The Philippine archipelago is made up of 7,107 islands. Together, the total area is 298,170 km2, which makes the country slightly smaller than Poland or Italy. The country’s capital Manila has about 13 million inhabitants; the economy’s growth rate is around 6% per year (2011-2015). The Philippines has a tropical marine climate with a northeast monsoon from November to April and a southwest monsoon between May and October. The country is usually affected by 15 typhoons and directly struck by five to six cyclonic storms each year. About 41% of the country is used for agriculture. Currently, the Philippines has a population of roughly 101 million, which grows 1.6% per year.

Big challenges

In conclusion, the Philippines is, classically, facing some big challenges if it wants to supply itself with more pig meat but it’s also clear that this is a country where opportunities beckon – and where the local industry has ambitions.

These challenges and the potential to grow have not gone unnoticed by the local supply chain. The investment decisions of the CP Group and others noted earlier are a sign that moves are afoot to develop the pig and pig meat industry but there are other straws in the wind.

A recent announcement of new power supply agreements between Aboitz Power Corporation and four of the largest members of Pampi; Foodsphere (CDO), Virginia Food, LIIP Food Processors (Century Pacific) and GenOSI (McDonald’s) is more evidence that wheels are turning and investments are being made. These major businesses need reliable and competitive power supplies to support their growing meat processing operations.

That Hog Industry Roadmap for 2017-2027 has an ambitious vision – a sustainable and globally-competitive hog industry by the year 2027. The Philippines is one country where we can expect plenty of action for the swine industry in the years ahead.

Dr John Strak

Editor Whole Hog

Content source: http://www.pigprogress.net/Finishers/Articles/2017/4/Swine-sector-in-the-Philippines-set-to-grow-123507E/

Submitted by: Carl Antonio Chua